The investment markets have seen a positive but volatile few months. Whilst April falls resulted in low returns for that quarter, a subsequent July recovery saw record highs in Global and Australian share markets.

Markets sharply fell again in the first 2 weeks of August. Factors impacting this include disappointing results in the Artificial Intelligence (AI) sector, a sluggish US jobs report and unexpected policy changes by the Bank of Japan.

Investors are more focused on fundamentals and some market commentators believe we’re in a time “where bad news is no longer good news for share markets”.

Share market returns from 1 January to 14 August 2024

The share market is highly concentrated.

The current market capitalisation concentrated in large US and Australian companies (large caps) is increasing share market volatility. In the US, the so-called MAG 7 stocks, were more than half of the gain in the S&P500 in the year to 30 June 2024 and the Top 10 Mega Cap stocks represented 38% of the Index at 30 June 2024. Importantly, the US market represents 70% of the MSCI World Index.

In Australia, the largest 6 stocks (4 major banks plus CSL and BHP) represented 38% of the market capitalisation of the ASX200 (top 200 stocks on the Australian Stock Exchange). The 4 major banks alone represent 22% of the ASX200 but delivered over 50% of the 2023/24 financial year returns. Due to this concentration, any increases or decreases in these few stocks have a magnified impact on the overall stock market, and market volatility.

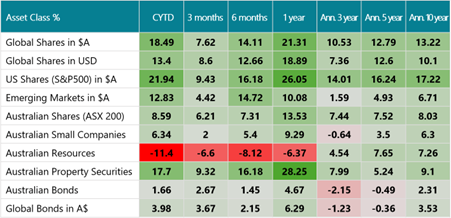

Returns of major asset classes at 31 July 2024

All major share market returns are solid, both on a calendar year-to-date (CYTD) and annual basis. While Europe has struggled, global share prices gained on the expectation of lower interest rates in Europe and the US later this year. US annual inflation came in at 3%, the lowest since March 2021. This together with signs of slower economic activity in the US lead to encouraging signals from the US Central Bank that interest rates will be cut soon.

Emerging markets have provided reasonable returns at 4.4% for the 3 months to the end of July 2024. Large differences between CYTD returns in China of -9.4% and India of 21.5% demonstrate that active management is recommended for this asset class.

Despite the strong gains in the Australian market in July, signs continue that the Australian economy is weakening along with that of our major trading partners. Global and Australian bonds had a strong quarter, both showing capital gains as yields fell due to lower global inflation. The Reserve Bank of Australia cash rate remains at 4.35%.

Outlook for economy and markets

Most economists such as global credit rating firm Moody’s have a positive outlook for the economy and markets and expect ‘soft landing’ (when an economy comes out of a strong growth cycle without entering a recession). Nevertheless, most also agree that recession concerns are rising. JP Morgan, for example believe that the probability of a US and global recession starting before the end of 2024 is 35%, increasing to 45% by the end of 2025.

Investors must remember that the solid returns we have enjoyed in the last few years were significantly boosted by unprecedented money being injected into the global economy by Governments and Central Banks in response to the COVID-19 pandemic.

The result was also a huge increase in global debt (for example US government debt of over USD35 Trillion, represents 126% of GDP). Nevertheless, investors remain focussed on the US economy, as developed markets outside the US, including Australia, are significantly weaker than the US.

The Australian economy is weak with retail sales and business forward orders declining but is benefiting from government spending and tax cuts along with immigration. This however is delaying any move by the RBA to cut rates until Q1 2025.

The present situation is complex and requires caution. Potential headwinds include:

- while there is a strong likelihood of significant interest rate cuts in the US over the next 12 months, these have already been priced into markets

- the COVID stimulus has been spent

- consumers are facing an unprecedented cost of living crisis at a time of record levels of household debt

- there are still significant inflation risks and

- geopolitical risks are very high.

Conclusion

We remain optimistic but cautious about the outlook for markets.

Conditions support the mantra of diversification. While we think returns from growth assets will remain positive overall there is an increased probability of more short-term market corrections. In this event, the defensive components of portfolios should provide good returns and the opportunity for capital growth in the case of bonds.

It is important to not overreact to short-term data when making investment decisions. We’re here to help you navigate the financial markets in these volatile times.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional. We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.