Australia’s strong economic recovery is expected to continue with broad based growth in consumption, investment, and exports alongside a stronger labour market, rising wages, income tax cuts, and stronger household income growth.

Whilst a stronger economy may help repair the Budget, with unemployment expected to fall below 4% this year, for the first time in 50 years, and higher near-term commodity prices, significant levels of deficit continue.

Russia’s invasion of Ukraine, the ongoing pandemic, and resulting inflationary pressures present risks to the economic outlook. Nonetheless, the resilience of the Australian economy throughout the pandemic demonstrates that the economy is well placed to adapt to these new developments.

It’s important to note that these are currently budget announcements only. Implementation of many of these initiatives will require their successful negotiation through Senate, where the sitting Government does not have a majority. Consequently, the final version of some of these measures may differ from these current announcements.

Personal taxation

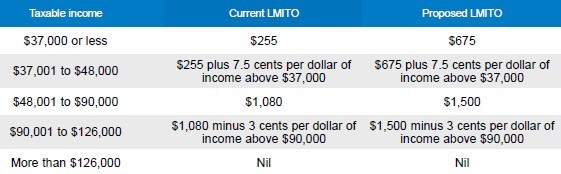

- The Low and Middle Income Tax Offset (LMITO) is proposed to increase to a maximum of $1,500 for 2021/22 (currently $1,080).

Other taxation initiatives

- Fuel excise cuts, the immediate halving of the fuel excise to around 22 cents per litre reduction for six months.

- Tax deductibility of COVID-19 test expenses in order to attend work (backdated from 1 July 2021).

- COVID-19 business grants remain non-assessable non-exempt income until 30 June 2022.

- Increasing the Medicare Levy-low income thresholds (for singles –increase by $139 to $23,365 for 2021/22).

- Employee share schemes for unlisted companies.

- For small businesses ‘Skills and training boost’ and ‘Technology and investment boost’.

Superannuation

Minimal superannuation changes (a good thing!).

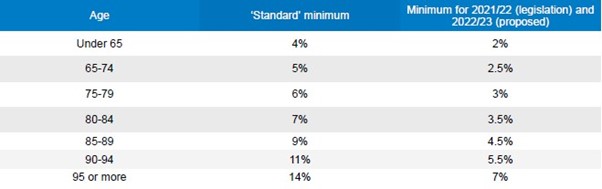

- Proposed to extend 50% reduction in pension minimum drawdown percentages for the 2022/23 financial year.

- Proposal to allow commutations of ‘certain income streams’.

- Superannuation Guarantee increase to 10.5% from 1 July 2022 (no announcement -existing legislation).

Social security, aged care and housing

- One-off $250 ‘Cost of Living’ payment to eligible social security recipients and concession cardholders, is expected to be paid automatically from late April to those currently eligible.

- Combining Parental Leave Pay (government) and Dad and Partner Pay. Alternate income test.

- Extending the home guarantee scheme from 1 July 2022, making up to 50,000 places available each year, 35,000 ‘First home guarantees’, and until June 2025, 10,000 ‘Regional home guarantees’ and 5,000 ‘Family home guarantees’ to support single parent families.

Women’s measures

- $2.1 billion funding covering initiatives across women’s safety, women’s economic security, and women’s health and wellbeing.

Initiatives from the 2021-22 Federal Budget coming into play from 1 July 2022

- Removal of the $450 per month threshold for the Superannuation Guarantee

- Downsizer contribution (up to $300,000 per person non-concessional into Superannuation) will be available from age 60, down from 65.

- First Home Super Saver Scheme increasing accessible amount per person from $30,000 to $50,000.

- No work test through to age 74 for non-concessional contributions.

- The use of bring forward non-concessional contributions through to age 74.

Sources: BT Federal Budget 2022/23 and https://budget.gov.au/

The information contained herein is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional. We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.